Custodial roth ira calculator

The Roth IRA contribution limit in 2021 is the lesser of 6000 or your childs total compensation for the year. In the case of a custodial Roth IRA this means your child.

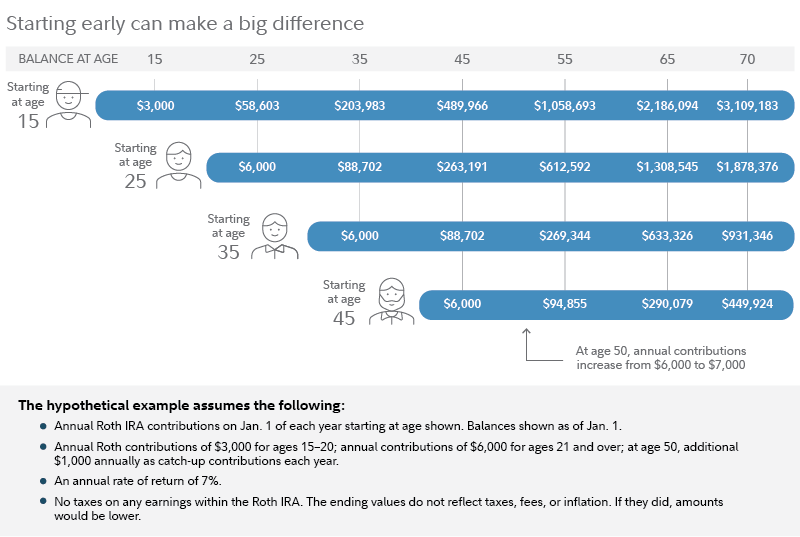

When Is The Best Time To Put Money In Your Ira

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

. A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Retirement Nest Egg Calculator.

Minors cannot generally open brokerage accounts in their own name until. By making contributions to a Roth IRA kids can. Call 866-855-5635 or open a.

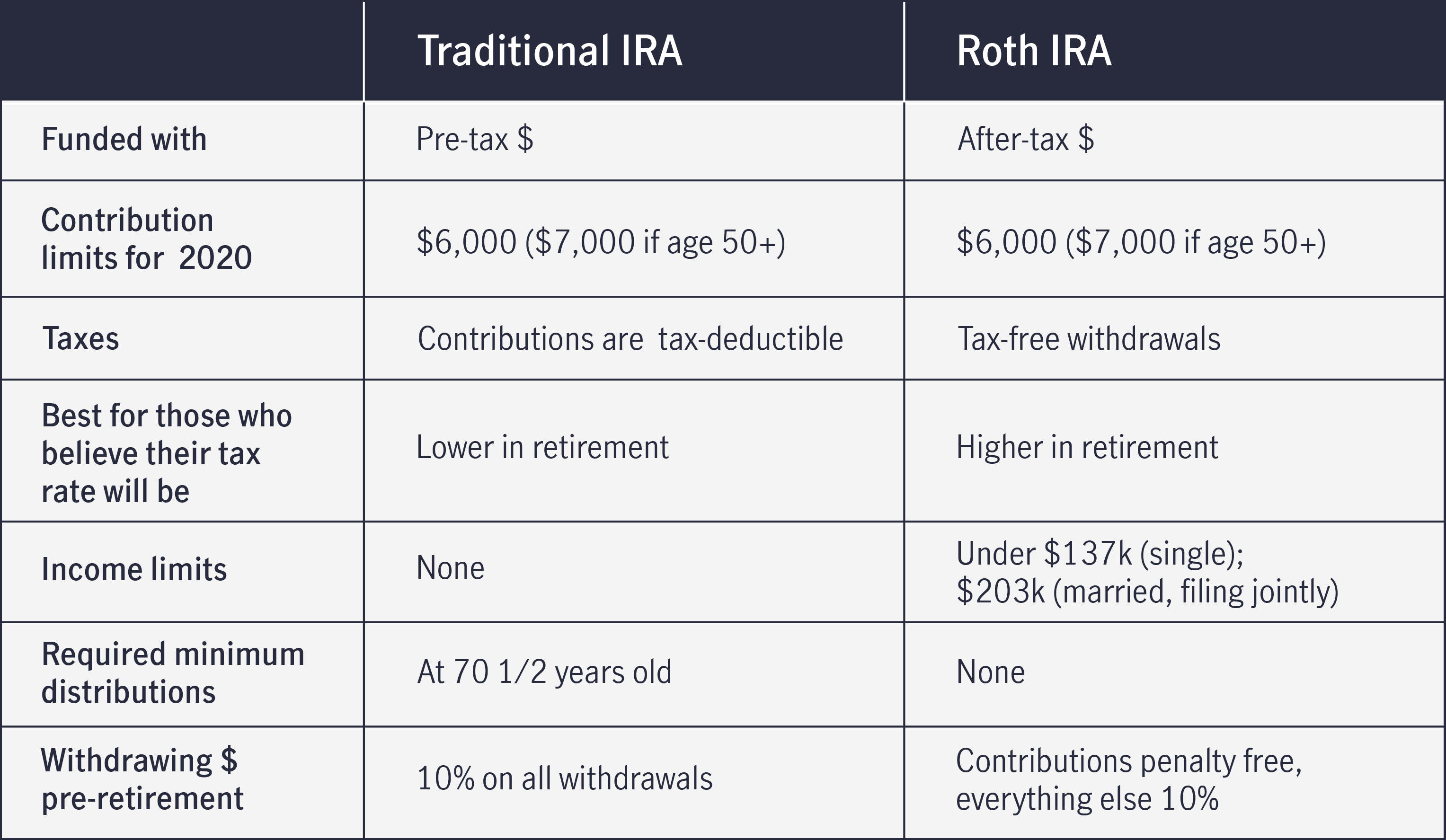

Not everyone is eligible to contribute this. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. Traditional IRA depends on your income level and financial goals.

Protect your retirement with Goldco. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. By thousands of Americans.

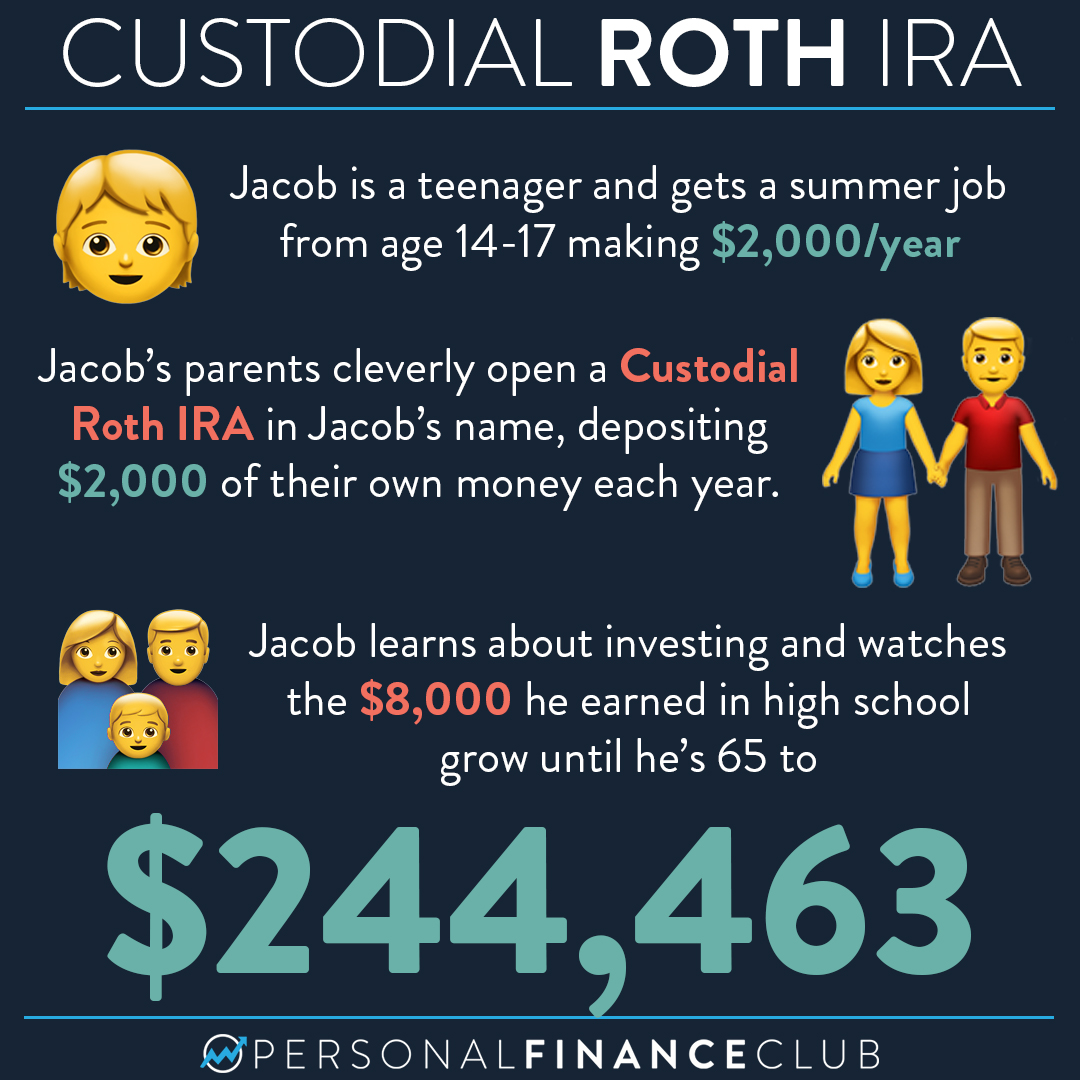

With a custodial Roth IRA you can help your kids establish good financial habits from a young age. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Suppose you contributed 250 per month to a custodial Roth IRA for your child from ages 14 to 18 with.

A custodial Roth IRA is managed on behalf of the account owner by an. A custodial Roth IRA is managed on behalf of the account owner by an. Ad Ready To Get Your Minor On The Right Track Toward Their Retirement.

Use our IRA calculators to get the IRA numbers you need. The income limits for 2022 for a custodial Roth IRA are the same as for the standard IRA. The accounts can be used for other important life events as well.

Reviews Trusted by Over 45000000. Call For More Info. To contribute to a Roth IRA or any type of IRA the account holder must have earned income.

Once the Custodial IRA is open all assets are managed. Retirement Savings Calculator. Compare 2022s Best Gold IRAs from Top Providers.

Request Your Free 2022 Gold IRA Kit. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you.

However they are seldom relevant for the Roth IRA for kids. Traditional IRA Calculator can help you. A Custodial IRA is an Individual Retirement Account that a custodian typically a parent holds for a minor with an earned income.

That is 41667 in month. A custodial Roth individual retirement account IRA is an investment vehicle established by a parent or other adult on behalf of a minor. A Roth IRA for Kids provides all the benefits of a regular Roth IRA but is geared toward children under the age of 18.

For example if your child earned 3000 mowing lawns theyd be. Traditional IRA Calculator can help you decide. What You Need To Know About The.

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Claim 10000 or More in Free Silver. For comparison purposes Roth IRA and.

To calculate the collective return of all three investments you would calculate the return of each depositso in the example 12 for the 12 months. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. Ad Top Rated Gold Co.

Custodial Roth IRAs convert to Roth IRAs when the minor turns 18 years old 21 years in some states. Choosing between a Roth vs.

How To Open Your First Ira Sofi

Setting Your Child Up To Be A Millionaire Roth Ira Finance Investing Saving For Retirement

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Financial Literacy Education Learn Finance Finance Saving Save Money College College Money

3jyzvuocctnujm

Custodial Roth Ira Retirement Accounts For Minors

Iras Traditional Vs Roth What S The Difference Time Value Of Money Business Benefits Creating Wealth

How To Open A Custodial Roth Ira For Your Kids Personal Finance Club

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Comparing Traditional Iras Vs Roth Iras John Hancock

Is A Roth Ira Considered A Brokerage Account

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

How To Open A Roth Ira 5 Easy Steps Seeking Alpha